kentucky inheritance tax calculator

Some states like Tennessee impose neither an inheritance or estate tax though. The estate tax was enacted in 1936.

Kentucky Income Tax Calculator Smartasset

The Kentucky inheritance tax is a tax imposed on certain beneficiaries who inherit property or money from a Kentucky estate.

. Inheritance taxes on the other hand are concerned about beneficiaries. The most recent change occurred in 1995 when a total exemption. KRS Chapter 140.

035 District Court. Estimate the value of your estate and how much inheritance tax may be due when you die. Kentuckys revised statutes krs 391035 outlines court procedures for the handling of.

Like most other states that impose this tax the Kentucky inheritance tax rates are straightforward and easy to understand. The KRS database was last updated on 05022022. Inheritance and Estate Taxes are two separate taxes that are often referred to as death taxes since both are occasioned by the death of a property owner.

Kentucky Inheritance and Estate Tax Laws can be found in the Kentucky Revised Statutes under Chapters. Up to 25 cash back The exact tax rate depends on the amount inherited. Inheritance and Estate Taxes KRS 140010 et seq Inheritance tax 416 percent.

Financial guarantee bonds like tax bonds Freight Broker Bonds and Health Club Bonds have proven. Inheritance tax paid on what you leave behind to your heirs and they could pay as much as 40 tax on what they inherit. 015 Exemption of benefits from federal government arising out of military service.

Pin On Housing Gia Ban điện Mặt Trời Solar Panels Best Solar Panels Solar House This Flowchart Could Help You Decide Whether To Buy Or Rent A Home Renting Vs Buying Home Renting A House Rent Vs Buy. 020 Taxation of transfers made in contemplation of death -- Revocable. In fact when the inheritance tax.

An inheritance tax is usually paid by a person inheriting an estate. The good news is that there are lots of ways to cut down your bill which. Includes enactments through the 2021 Special Session.

Inheritance tax returns are usually due within one year and some states offer discounts for filing earlier. Only about 12 of 1 of people will pay an estate tax. 010 Descent of real estate.

The inheritance tax in this example is 76670. The major difference between estate tax and inheritance tax is who pays the tax. While they do assess an income tax and of course real estate taxes there is no estate tax.

Kentucky Inheritance and Gift Tax. The tax to Class C beneficiaries for gifts of that size is calculated at 28670 plus 16 of the amount over 200000. Call an experienced estate planning attorney like Anna M.

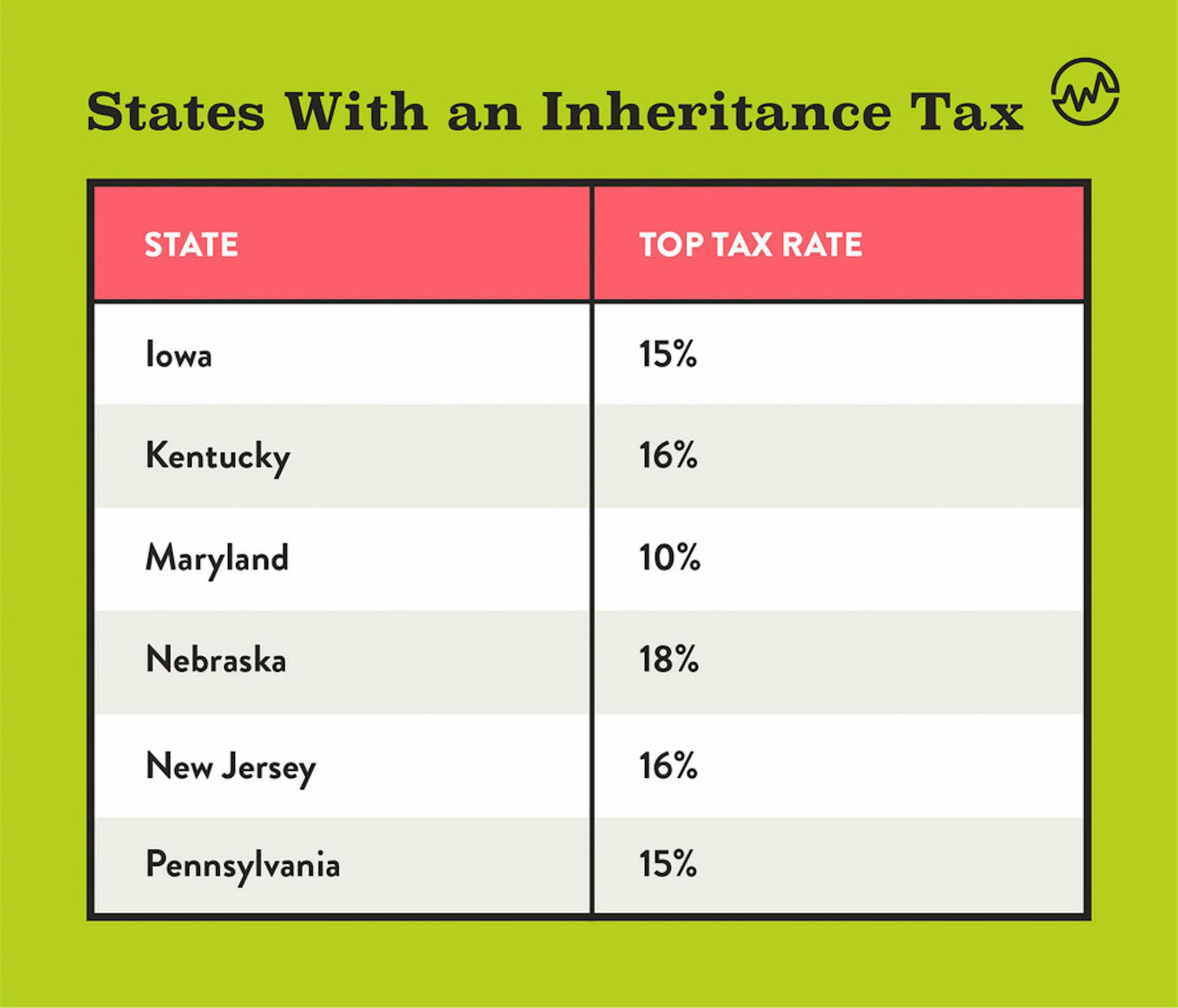

For questions or to submit an incentive email the Technical Response ServiceFor additional incentives search the Database of State Incentives for Renewables Efficiency. Class A beneficiaries pay no taxes on their inheritances. State inheritance tax rates range from 1 up to 16.

The highest property tax rate in the state is in Campbell County at 118 whereas the lowest property tax rate in Kentucky is 056 in Carter County. The tax is only levied against estates for individuals who have net assets that exceed 117 million for 2021. Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance tax.

For a detailed chart see the inheritance tax table in the Kentucky Department of Revenues Inheritance Tax Guide. As a result it will not be assessed against many folks. Class B beneficiaries pay a tax rate that can vary from 4 to 16.

Most states do not impose an inheritance tax or an estate tax. Kentucky inheritance tax calculator Friday March 25 2022 Edit. The state of Kentucky considers a wide range of items taxable including.

The value of all bank and investment accounts. Affiant further states that a Kentucky Inheritance Tax Return will not be filed since no death tax is due the state and a Federal Estate and Gift Tax Return Form 706 is not required to be filed because the gross estate is less than the required amount set out in Section 2010c of the Internal Revenue Code. The size of the inheritance and the beneficiary.

The first 50000 is taxed at 10. By way of example if the deceased person was a resident of Kentucky rather than a nonresident who owned property in Kentucky a. The tax has seen several significant changes through the years.

The inheritance tax is not the same as the estate tax. This affidavit is being. The kentucky inheritance tax is a tax on a beneficiarys right to receive property from a deceased person.

Inheritance and Estate Taxes. The Kentucky inheritance tax is a tax on the right to receive property upon the death of another person. Your household income location filing status and number of personal exemptions.

033 Limitation on right to estate if parent has abandoned care and maintenance of child. States levy inheritance tax on money and assets after theyre already passed on to a persons heirs. Connecticut has an estate tax ranging from 108 to 12 with an annual exclusion amount of 71 million in 2021.

Updated for the 2021-22 tax year. Our income tax calculator calculates your federal state and local taxes based on several key inputs. 030 Descent of personal property -- Exemption for surviving spouse and children -- Withdrawal of money from bank by surviving spouse.

The estate tax is paid based on the deceased persons estate before the money is distributed but inheritance tax is paid by the person inheriting or receiving the money. The siblings who inherit will then pay a 11-16 tax rate. For more information see page 2 of the Guide to Kentucky Inheritance and Estate Taxes.

The Kentucky inheritance tax was adopted in 1906 making it the second oldest General Fund tax. The beneficiary only has to file a tax return if his or her inheritance is considered taxable. The inheritance tax is not the same as the estate tax.

Inheritances in Kentucky are taxed based on the recipients relationship to the deceased as well as the value of the property. Thanks to something called portability this estate tax exemption limit can be increased in many situations. Its important to calculate and pay these taxes promptly.

The rate of tax and the exemptions allowed depend on the legal relationship of the beneficiary to the decedent. By contrast a nephew in Iowa has a different tax rate. Beneficiaries are responsible for paying the inheritance tax.

Price from Jenkins Fenstermaker PLLC toll-free at 866 617-4736 or use Annas online contact form to set up a consultation. If you have additional questions about Kentuckys inheritance tax please do. Anna is licensed to practice law in Kentucky and West Virginia and enjoys.

There are a total of 120 counties in the state of Kentucky and each county houses a different tax rate. Inheritance Estate Tax. The last thing a testator wishes to leave his loved ones is an unexpected tax bill.

In Iowa siblings will pay a 5 tax on any amount over 0 but not over 12500. As you can imagine there are nuances to this tax beyond those which can be explained here. Kentucky does have an inheritance tax.

020 Descent of real estate acquired from parent. The higher the amount the higher the tax rate. KRS Chapter 391.

In 2022 Connecticut estate taxes will range from 116 to 12 with a 91-million. 010 Levy of inheritance tax -- Property affected -- When tax attaches. For any amount over 12500 but not over 25000 then the tax rate is 6 plus 625.

Surviving spouses are always exempt.

Kentucky Income Tax Calculator Smartasset

How Is Tax Liability Calculated Common Tax Questions Answered

Do I Need To Pay Inheritance Taxes Postic Bates P C

Calculating Inheritance Tax Laws Com

Maryland Inheritance Tax Calculator Probate

Salary Calculator Ky Salary Information Websites

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Estate Inheritance And Gift Taxes In Connecticut And Other States

Salary Calculator Ky Salary Information Websites

Inheritance Tax 2022 Casaplorer

Kentucky Rural Housing Development Mortgage Guide For 2021 Usda Loans Kentucky Usda Mortgage Lender For Rural Housing Loans Mortgage Usda Usda Loan

Green Check Mark In Box Animated Clipart Planning Tool Clip Art

Kentucky Estate Tax Everything You Need To Know Smartasset

The Kentucky Income Tax Rate Is 5 Learn How Much You Will Pay On Your Earnings

Even Though You May Be Receiving An Unexpected Inheritance You May Still Have Some Valid Concerns About What Estate Planning Attorney How To Plan Inheritance

How To File The Inventory Tax Credit Department Of Revenue

How To Calculate Inheritance Tax 12 Steps With Pictures