georgia ad valorem tax refund

Quick Links Georgia Tax Center. MV-33 - Georgia Department of Revenue DOR Title Ad Valorem Tax TAVT.

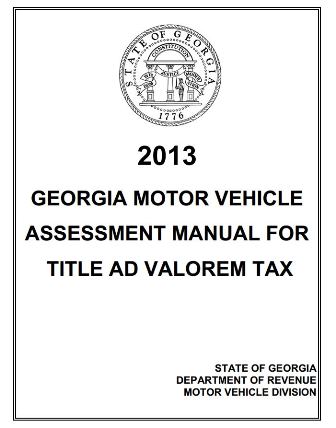

2013 Vehicle Valuation Manual Title Ad Valorem Tax Diminished Value Of Georgia

Request an additional six months to file your Georgia income tax return.

. How does TAVT impact vehicles that are leased. Georgia ad valorem tax refund. State of Georgia government websites and email systems use georgiagov or gagov at the end of the address.

TAVT is a one-time fee that replaces the sales tax and the annual ad valorem tax often referred to as the birthday tax on motor vehicles. Some of the services and benefits. If itemized deductions are also.

Instead the purchased vehicles are subject to a one-time title ad valorem tax TAVT. Ad Valorem Tax Refunds If a taxpayer discovers they have paid taxes that they believe were illegal or erroneous they may request a refund within 3 years of the date of payment. GA Code 48-5-47 65 Years of Age and Low Income Exemption Individuals 65 Years of Age and Older May Claim a 4000 Exemption.

The claim for refund should be filed in writing with the board of commissioners within three years after the date of. We make no warranties or guarantees about the accuracy completeness or adequacy of the information contained on this site or the. To itemize your deductions for ad valorem taxes you have to give up your standard deduction.

Local state and federal government websites often end in gov. Ad valorem tax more commonly known as property tax is a large source of revenue for governments in Georgia. Also refer to Regulation 560-3-2-27 Signature Requirements for Tax Returns.

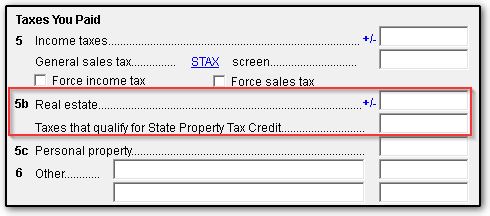

The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state. Ad valorem tax more commonly known as property tax is a large source of revenue for local governments in Georgia. This tax is based on the cars value and is the amount that can be entered on Federal Schedule A Form 1040 Itemized Deductions for an itemized deduction if the return qualifies to itemize deductions rather than take the standard deduction.

You will now pay this one-time title fee when registering your car. The family member who is titling the vehicle is subject to a 05 title ad valorem tax. Services Benefits Property taxes along with collection of sales tax license and permit fees fines and forfeitures and charges for services bring in the majority of the funds used to fund the Athens-Clarke County government.

Use Ad Valorem Tax Calculator. Ad valorem tax for state purposes will be due on the assessed value of land that exceeds the 10 acre limitation. Vehicles purchased on or after March 1 2013 and titled in Georgia are exempt from sales and use tax and the annual ad valorem tax ie.

Instead it appears to be a tax in the nature of a sales tax. A reduction is made for the trade-in. The tax is levied on the assessed value of the property which by law is established at 40 of the fair market value.

Using the IRS requirements Georgia will permit paid preparers to sign original returns amended returns or requests for filing extensions by rubber stamp mechanical device such as signature pen or computer software program. This value is calculated by averaging the current wholesale and retail values of the motor vehicle pursuant to OCGA. State of Georgia government websites and email systems use georgiagov or gagov at the end of.

If a vehicle is used for business the title tax should be added to the cost basis like a sales tax. The links below are reports that show the ad valorem taxes that were levied by local counties schools and cities for the indicated tax year. MV-33 Georgia Department of Revenue Title Ad Valorem Tax TAVT Refund Request.

The basis for ad valorem taxation is the fair market value of the property which is established January 1 of each year. The tax must be paid at the time of sale by Georgia residents or within six months of establishing residency by those. Accordingly the fair market value for a used motor vehicle for purposes of TAVT will generally be the same as the value that was used in the old annual ad valorem tax system.

The full title ad valorem tax or continue to pay the annual ad valorem tax under the old system. Related Topics Ad Valorem Vehicle Taxes. Tax amounts vary according to the current fair market value of the vehicle and the tax district in which the owner resides.

Related Agency Department of Revenue. Ad valorem taxes are due each year on all vehicles whether they are operational or not even if the tag or registration renewal is not being applied for. Some of the taxes levied may not be collected for various reasons assessment errors insolvency bankruptcy etc.

Vehicles purchased on or after March 1 2013. Ad Valorem Vehicle Taxes. If you purchased your vehicle in Georgia before March 1 2013 you are subject to an annual tax.

Taxes must be paid by the last day of your registration period birthday to avoid a 10 penalty. Georgia Title Ad Valorem Tax Updated Youtube MV-33 Georgia Department of Revenue. If a taxpayer discovers they have paid taxes that they believe were illegal or erroneous they may request a refund within 3 years of the date of payment.

The new Georgia Title Ad Valorem Tax TAVT is not deductible as a property tax as it is not imposed on an annual basis. In order to be deductible as a personal property tax it. Georgia may have more current or accurate information.

This calculator can estimate the tax due when you buy a vehicle. The Title Ad Valorem Tax TAVT or Title Fee was passed by the 2012 Georgia General Assembly with additional amendments made during the 2013 legislative session. For the answer to this question we consulted the Georgia Department of Revenue.

CHAPTER 5 - AD VALOREM TAXATION OF PROPERTY ARTICLE 4 - COUNTY TAXATION 48-5-241 - Refund or credit of county taxes OCGA. The State of Georgia has an Ad Valorem Tax which is listed on the Motor Vehicle Registration certificate. The property taxes levied means the taxes charged against taxable property in this state.

Thus the tax would be deductible on Schedule A of Form 1040 if you itemize as part of your state and local sales tax paid however if you choose to deduct sales tax you cannot claim the. Georgia law does not allow a refund for partial year residents. This tax is based on the value of the vehicle.

For the 2014 tax year the standard deduction is worth 6200 9100 or 12200 depending on if you file taxes alone as a head of household or as a married couple filing jointly. The deductions typically adjust up with inflation every year.

2021 Property Tax Bills Sent Out Cobb County Georgia

What Is A Homestead Exemption And How Does It Work Lendingtree

Property Overview Cobb Tax Cobb County Tax Commissioner

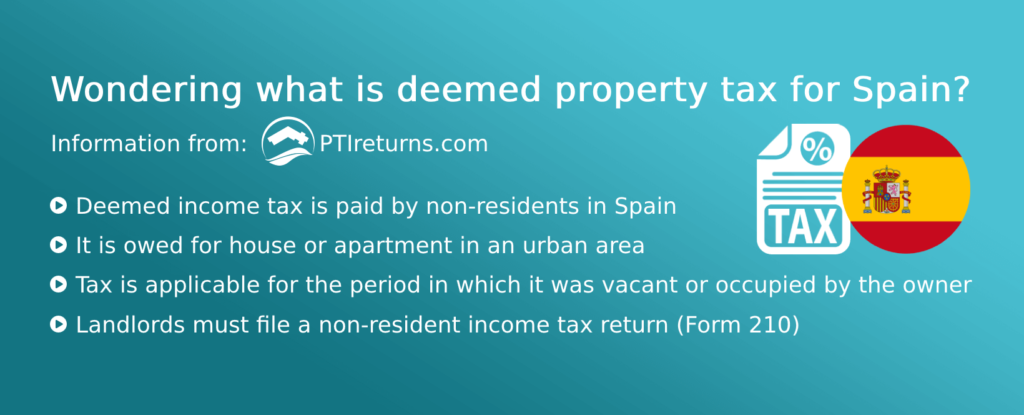

What Are Deemed Tax Returns For A Property In Spain Pti

Property Tax In Pakistan 2019 2021

An Independent Contractor Who Receives 1099 Misc Forms Instead Of W 2s May Want A Second Pair Of Eyes On Their Returns Tax Write Offs Tax Prep Tax Preparation

Tax Information City Of Fairview Park Ohio

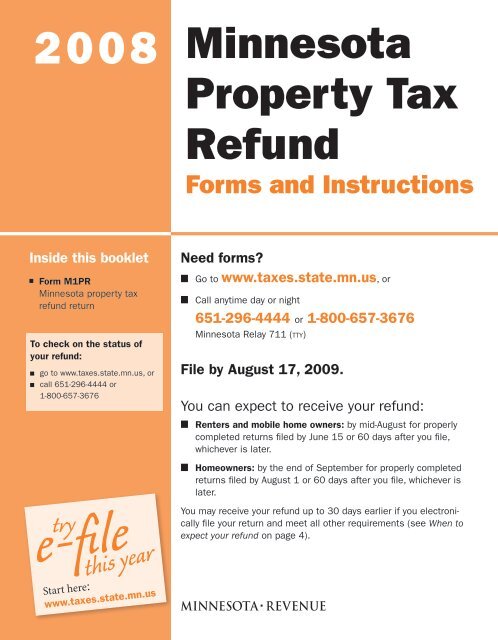

2008 Property Tax Refund Return Form M1pr Instructions

Ad Valorem Tax Overview And Guide Types Of Value Based Taxes

Which States Have The Lowest Property Taxes Property Tax American History Timeline Usa Facts

Buying Land As A Business Expense Deductions Facts In 2022 Business Expense Workers Compensation Insurance Social Media Marketing Campaign

Georgia Tax Forms 2019 Printable State Ga Form 500 And Ga Form 500 Instructions Tax Forms Tax Return Estimated Tax Payments

What Are Ad Valorem Taxes Henry County Tax Collector Ga